Homo Oeconomicus And The Monetary Basis For A Big Society

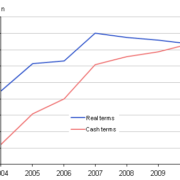

Jesse Norman’s book on the Big Society, which I reviewed recently, caused me to reflect once again on Homo Oeconomicus, that totally un-human being, that rationally calculating bundle of circuits, which mechanically responds to events to maximise its utility. We know utility is a thoroughly personal, subjective measure that is taken by the economics profession to be objective, and capable in society of being maximised. Norman rightly ridicules this concept, calling it delightfully “rigor mortis economics”. Thus he is on the side of all economics pre-Keynes and post-Keynes, and particularly in line with the Austrian view. Norman shows that the credit induced boom of the Labour years did not create real and lasting wealth. He shows that savings are the essential ingredient in any capital formation, and that capital formation is the wellspring of good fortune in our society. A demand-led (consumption-led) society will only end up cannibalising itself if saving, and thus capital formation, is not prioritised. However, at no point in the book do we see a discussion that we have on this website all the time: how the agent of all this credit creation is the state itself, with the monopoly central bank being able to manipulate the reserves of the private sector bank to fulfil an interest rate policy set by the politicians. ALL responsibility for the Great Recession rests in the hands of politicians around the world. Thus, a weakness in the book is that with no money reform agenda to run in parallel with a reformist Big Society agenda, the connected society may well be doomed from the outset. This is my worry with this work: that its vision does not yet sit on solid foundations of honest money. If the two were inextricably linked, then I think we’d have an economic and political agenda that is very credible, and which and would set the country on a path of peaceful and stable growth. When people can plan for their own future, without fear of their wealth being confiscated by currency debasement, or destroyed by recurring recessions, they are in a much better position to help others. The Big Society agenda is very much in tune with the Manchester School social reformers who have inspired the creation of this web site. We wish Cameron well in his practical application of this very British tradition. Norman gives this current form of politics its intellectual muscle and brain power. I hope both will underscore their work with an honest money agenda, otherwise we will keep on having to revisit these problems every generation.

![spirit-level-why-greater-equality-makes-societies-stronger[1]](https://tobybaxendale.com/wp-content/uploads/2013/07/spirit-level-why-greater-equality-makes-societies-stronger1-180x180.jpg)

![banksign[1]](https://tobybaxendale.com/wp-content/uploads/2013/07/banksign1-180x180.jpg)