Gross Domestic Expenditures

If you want to read a very genuine and new contribution to the body of knowledge set out in academic terms, I recommend this paper by Mark Skousen:

Here’s the introduction:

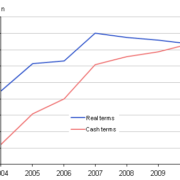

In national income and product accounts, Gross Domestic Product (GDP) is widely recognized as the most common denominator of economic performance. However, because it measures final output only, GDP overemphasizes the role of consumer spending as a driver of economic growth rather than saving, business investment, and technological advances. In an effort to create a more balanced picture of the production/consumption process, I create Gross Domestic Expenditures (GDE), a new national aggregate statistic that measures sales at all stages of production. Drawing from the annual input-output data compiled by the Bureau of Economic Analysis, gross business receipts from the IRS, and other sources, GDE estimates gross spending patterns in intermediate production (goods-in-process) and final output. GDE should be the starting point for measuring aggregate spending in the economy, as it measures both the “make” economy (intermediate production), and the “use” economy (final use or GDP). It complements GDP and can easily be incorporated in standard national income accounting and macroeconomic analysis. In the United States, GDE appears to be more than twice the size of GDP, and has historically been three times more volatile than GDP, and serves as a better indicator of business cycle activity. I conclude that consumer spending represents approximately 30 percent of total economic activity (GDE), not 70 percent as often reported. This conclusion is more consistent with the leading economic indicators published by the Conference Board.

Sean Corrigan has published something similar on our site, and he comes to the same conclusions: the unmeasured part of the economy, the producing part, is 3 to 1 to the final goods part. This erroneous GDP measure leads economists to be able to claim that consumer spending is some 70% of all economic activity as it is mainly the final goods, i.e. the consumption goods, that are measured in standard GDP statistics . In simple terms, when I used to sell fish in this country I bought fresh landed fish at auction. I would then take it back to my factory and cut to the bespoke requirements of our chef customers. Only the value-adding part of this process would be included, so as to avoid double counting of the final goods sold that make up the GDP stats. The restaurateur would only have the value adding he does measured. In short, if you eat some fish and chips in a restaurant, GDP measures the initial price of the raw material plus the value added in each sector of the economy it passes through until you eat it. As far as the GDP numbers are concerned, you have eaten the raw material and the difference between the raw material and the battered fish and chips. My prior company, Seafood Holdings, was the largest fresh fish seller to the food service sector and as far as the GDP measure was concerned, we did not exist! Skousen’s GDE measure shows how the larger producer sector in the economy is much more sensitive to things like interest rate movements that, according to the Austrian Theory of the Business Cycle, will cause greater investment in the productive sector as it seeks to make more things. Empirical support is offered by this paper for the ATBC, if it were required! Prof Skousen provides a very simple pedagogical approach to measure the entire production process to create a full picture of what goes on in the economy where all sectors activities are measured. This shows us how important prior production is before you even get to the consumption sector. This shows us that the consumption sector is not 70% of the economy but closer to 30%. This shows us that the desire to stimulate consumption over and above anything else is misguided. This means that our political masters and their court economists are looking at the economy with a partial eye patch on one eye and a cataract on the other. Surprised? I thought not. Legislators who read this site, please take note! You need to produce something to be able to consume something. You can’t consume something unless you have done, or someone else has done, some prior production of a good or service of some use to your fellow man. To be able to produce more things, we need to save, not spend on consumption. It was an axiom of Keynes, that final demand determined the level of prosperity in the economy. It is the exact opposite: production precedes consumption. Also, that whole productive sector of the economy dwarfs the size of the consumption sector 3:1. Policy makers should be putting all their efforts to removing barriers for wealth creation in that sector and encouraging savings. The German people seem to get this. The mercantilist policy of Keynes and his follows needs periodic refutation. Like a Zombie waking up from the dead, it perpetually haunts our policy makers. Prof Skousen provides a rigorous statistical paper and methodology to help slay the Keynesian beast once more.

![image[1]](http://109.104.118.106/~toby/wp-content/uploads/2013/07/image1.png)